Table of Contents

- What Are the Latest CPP and OAS Payment Rates for 2025?

- Who Qualifies for the Maximum CPP Payment?

- Details on the OAS Rate Confirmation

- When Will These Payments Start?

- How Are CPP and OAS Payments Calculated?

- Steps to Ensure You Receive Your Full Payments

- Frequently Asked Questions (FAQs)

- Where to Find Official Information

What Are the Latest CPP and OAS Payment Rates for 2025?

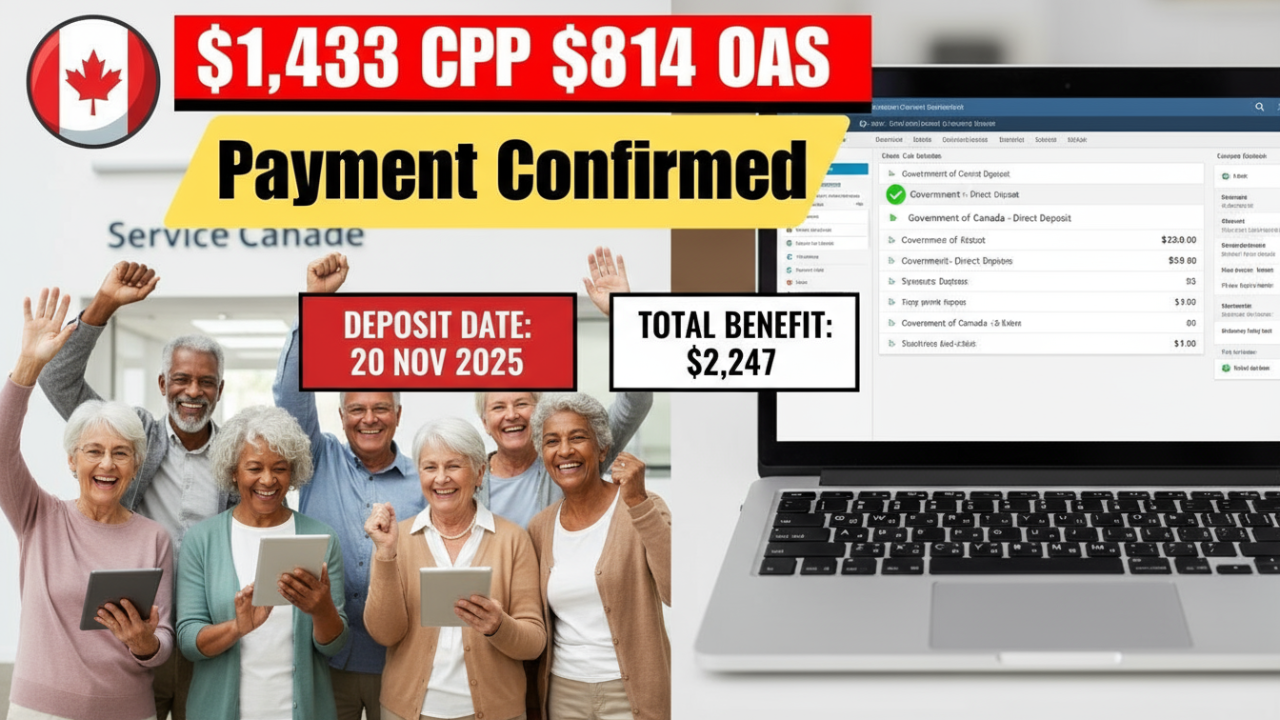

Starting November 2025, the Canada Pension Plan (CPP) maximum monthly payment has been confirmed at $1,433, while the Old Age Security (OAS) pension rate is set at $814 per month. These increases provide a critical boost to senior Canadians’ retirement income as part of regular annual adjustments for inflation and earnings.

Who Qualifies for the Maximum CPP Payment?

The maximum CPP payment of $1,433 is available to retirees who:

- Have contributed at or near the maximum annual contribution level (based on the maximum pensionable earnings) for at least 39 years.

- Reach the standard CPP retirement age (typically 65 years).

- Have submitted all necessary paperwork and maintain eligibility through Service Canada.

Partial contributors receive proportionally lower payments based on their contribution history.

Details on the OAS Rate Confirmation

The OAS rate of $814 per month applies to eligible seniors aged 65 and above residing in Canada, based on income and residency qualification. This payment is a non-contributory benefit aimed at ensuring a basic standard of living for seniors.

When Will These Payments Start?

Payments reflecting the confirmed rates will commence on November 27, 2025, deposited into eligible seniors’ bank accounts through direct deposit or cheque payment where applicable.

How Are CPP and OAS Payments Calculated?

- CPP payments consider your total contributions and retirement age, with adjustments each year according to wage inflation or fixed minimum rates (triple lock mechanism).

- OAS payments depend on residency duration in Canada, with means tested based on income level to gauge offset amounts.

Steps to Ensure You Receive Your Full Payments

- Make sure your banking details are up to date with Service Canada.

- File your annual income tax returns timely to avoid disruption.

- Keep your personal information current, including marital status, as payments depend on household income.

- Check Service Canada online accounts regularly to verify payment schedules.

Frequently Asked Questions (FAQs)

Q1: What if I haven’t contributed the full CPP amount—will I get $1,433?

A1: No, that amount is for full contributors; others get partial payments linked to contributions.

Q2: Can OAS and CPP payments be deferred?

A2: Yes, you can defer CPP up to age 70 for increased pension; OAS deferral options are limited.

Q3: Is the OAS rate taxable?

A3: Yes, OAS payments count as taxable income.

Q4: Do these new rates apply automatically?

A4: Yes, eligible recipients will receive updated rates automatically without action.

Q5: Where can I learn more or check my specific payment?

A5: Visit the Service Canada website or call their support center.

Where to Find Official Information

For accurate, up-to-date CPP and OAS information and support, please visit:

The confirmed maximum CPP payment of $1,433 and OAS rate of $814 in November 2025 provides essential financial security for Canadian seniors. Ensure your records are current and stay informed to take full advantage.